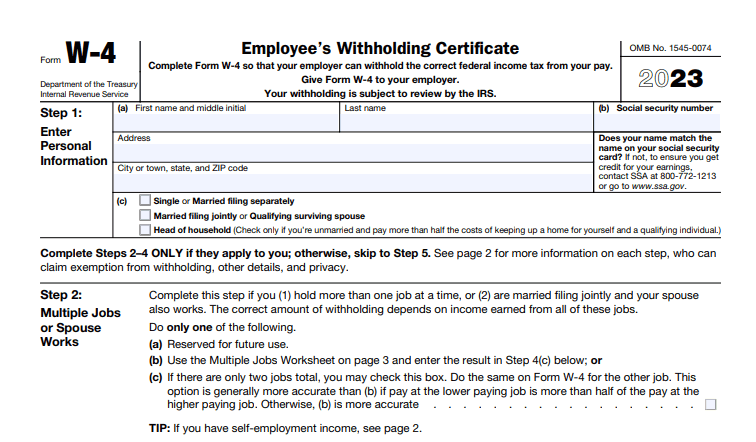

The W-4 form, also known as the Employee’s Withholding Allowance Certificate, is an important document for employers and employees to understand. It is used to determine the amount of federal income tax that should be withheld from an employee’s pay. With the release of the new W-4 form for 2023, it’s important to understand the changes and how to properly fill out and submit the form. In this article, we will provide a comprehensive guide to the W-4 form 2023, including how to fill it out, where to find it, and how it affects your taxes.

What is the W-4 Form?

The W-4 form, also known as the Employee’s Withholding Allowance Certificate, is a form that employees fill out to indicate their tax filing status and the number of exemptions they are claiming. This information is used by the employer to determine the amount of federal income tax that should be withheld from the employee’s pay. The form is issued by the Internal Revenue Service (IRS) and must be filled out by all new employees upon hire.

Changes to the W-4 Form 2023

The new W-4 form for 2023 includes several changes from the previous version, including the removal of certain personal allowance worksheets and the addition of a “multiple jobs or spouse worksheet.” The form also includes a new section for employees to indicate if they have a non-working spouse or dependents, which will affect their withholding.

How to Fill Out the W-4 Form 2023

Filling out the W-4 form can be confusing, especially with the changes in the 2023 version. The IRS provides a withholding calculator and a publication called “Publication 505: Tax Withholding and Estimated Tax” to help employees determine the correct number of exemptions to claim. Additionally, there are resources available such as “how to fill out a W4 for dummies” that can assist in understanding the process.

Additional Forms: I-9 and W-4P

Along with the W-4 form, employers are also required to have their employees fill out the Form I-9, which is used to verify an employee’s eligibility to work in the United States. Additionally, employees who are considered “retired” and receiving pension income may need to fill out a W-4P form, which is used to determine the amount of federal income tax that should be withheld from their pension payments.

W-4 vs W-2 Form

It’s important to understand the difference between the W-4 form and the W-2 form. The W-4 form is used to determine the amount of federal income tax to be withheld from an employee’s pay, while the W-2 form is used to report the employee’s total wages and taxes withheld for the year. Employers are required to provide employees with a W-2 form by January 31st of each year, which is used when filing taxes.

Comparison of W-4 and W-2 Forms

| Form | Description |

|---|---|

| W-4 Form | Used to determine the amount of federal income tax to be withheld from an employee’s pay |

| W-2 Form | Used to report the employee’s total wages and taxes withheld for the year |

Conclusion

The W-4 form is an important document for both employers and employees to understand. With the release of the new W-4 form 2023, it’s important to understand the changes and how to properly fill out and submit the form. By following the guidelines provided in this article, including the use of resources such as the withholding calculator and “how to fill out a W4 for dummies,” employees can ensure that the correct amount of taxes are being withheld from their pay.

Additionally, it’s important for employers to be aware of the Form I-9 and the W-4P form, and the difference between the W-4 and W-2 forms. By staying informed and compliant with the regulations set forth by the IRS, both employers and employees can avoid any potential issues with taxes and withholding.